Dave Ramsey Says Your Vehicles Should Not be Worth More Than Half Your Annual Income

Dave Ramsey, a famous financial guru and radio host, has spent his entire career helping people get out of debt and successfully manage their money. And his most recent advice is certainly getting people’s attention.

On his X profile, Ramsey told his followers that all their motorized vehicles should not “have a total value that exceeds half [their] annual income.”

Who is Dave Ramsey?

Before diving into Dave’s viral advice, it’s first important to understand who he is and why so many people are taking his words seriously.

Source: Amazon

Dave Ramsey has written several books and hosts a radio show as a financial expert who specializes in helping people organize their money in a way that keeps them out of debt.

Ramsey’s On-Going Advice

In addition to his show, on which he answers people’s specific questions, and his books, where he breaks down his professional opinions, the now-famous author and host is constantly posting helpful tips on his X, formerly Twitter, page.

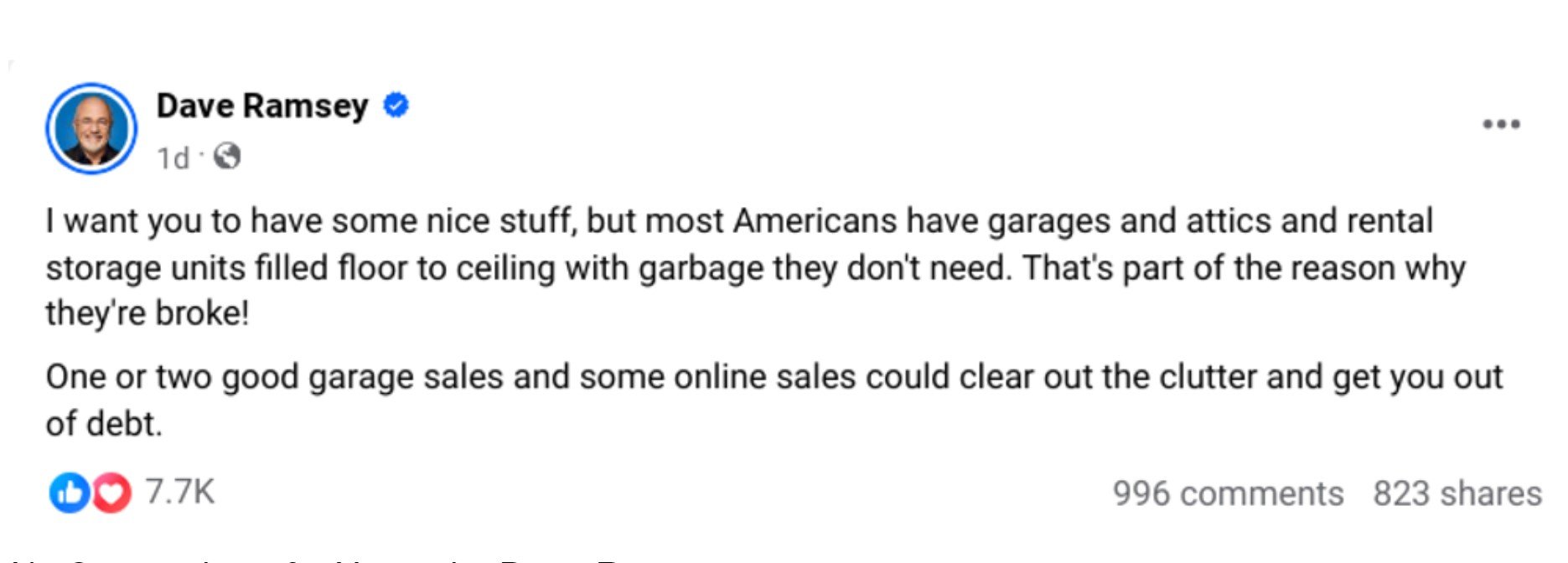

Source: Facebook

Generally, the posts are broad but informative, as he strives to help everyone understand that there are ways to get out and stay out of debt.

The Suggestion that Went Viral

Within his dozens of posts, his many followers, as well as the world at large, are talking about one in particular.

Source: Ramsey Solutions

Ramsey posted, “Your cars, trucks, boats, motorcycles, and other vehicles should not have a total value that exceeds half your annual income. Why? You don’t want too much of your wealth tied up in things that depreciate. And cars, trucks, and things with motors depreciate big time.”

Why Should All Your Motor Vehicles Add Up to Half Your Annual Income?

In an article on Ramsey’s website, the expert explained his reasoning: “You don’t want too much of your wealth tied up in things that depreciate (or go down in value). And things with motors depreciate big time.”

Source: Facebook

He also said, “Every day you hold onto it, it’s worth less and less. In other words, you’re losing money.”

Is Ramsey Right About Depreciation?

It’s important to understand that Ramsey couldn’t be more right when it comes to car, boat, and motorcycle depreciation.

Source: Freepik

One of Ramsey’s fellow experts, George Kamel, explained that a “brand-new car loses about 11% of its value the moment you drive it off the lot.”

The Facts About Car Depreciation

Kamel went on to say, “If you bought a car tomorrow for $20,000 and then sold it three years from now for $12,000, that means your car lost 40% of its value during the three years you owned it.”

Source: Freepik

Essentially, after just one year, a car can depreciate up to 20%. So what Ramsey is explaining is that this car that you spent a fortune on will be worth next to nothing in about five years.

How Much Should a Person Spend on a Car?

According to Ramsey, this unfortunate reality means that people should be extremely careful with how much money they spend on a car.

Source: Freepik

Ramsey said it as clearly as possible when he wrote: “The car you can afford is the car you can pay for in cash.”

The Majority of Americans Owe Money on Their Car

That statement alone would certainly get the attention of the majority of Americans, as almost no Americans pay for their cars outright with cash.

Source: Freepik

In fact, according to LendingTree, Americans “owe $1.56 trillion in auto loan debt.” Additionally, they noted that it will take the average American more than five years to pay back their auto loan, by which time, their car will be worth nothing.

Ramsey’s Not Just Talking About Cars

For many, the idea of paying for a car with cash or even opting for a car that costs less than half someone’s annual salary is a big change, but Ramsey isn’t just talking about cars.

Source: Freepik

His advice clearly states that all motorized vehicles a person owns should add up to only half of their yearly income. That includes boats, jet skis, four-wheelers, lawnmowers, and motorcycles.

It’s Okay to Own Motorized Vehicles, Just Know They Are Not Great Financial Investments

Ramsey’s entire platform is based on the idea that many people simply don’t understand why or how they are in debt. And he wants people to understand that while it’s certainly okay to have motorized vehicles, they are not financial investments.

Source: Freepik

Some people incorrectly assume that they will be able to sell their boats, motorbikes, and cars in the near-to-distant future and get at least some of the money back they spent, but Ramsey is here to say that is a complete misconception.

Ramsey Tells It Like It Is

According to Ramsey, his bottom line is, “Of course, I want you to have nice things, but I also want you to be able to afford them.”

Source: Ramsey Solutions

So, while all of your friends and family may be getting an auto loan that looks like a great deal, the truth is that the best possible way to stay out of debt and make smart financial investments is to buy only a car, boat, or bike that you can afford right now.